Which of the Following Transactions Qualify as a Discontinued Operation

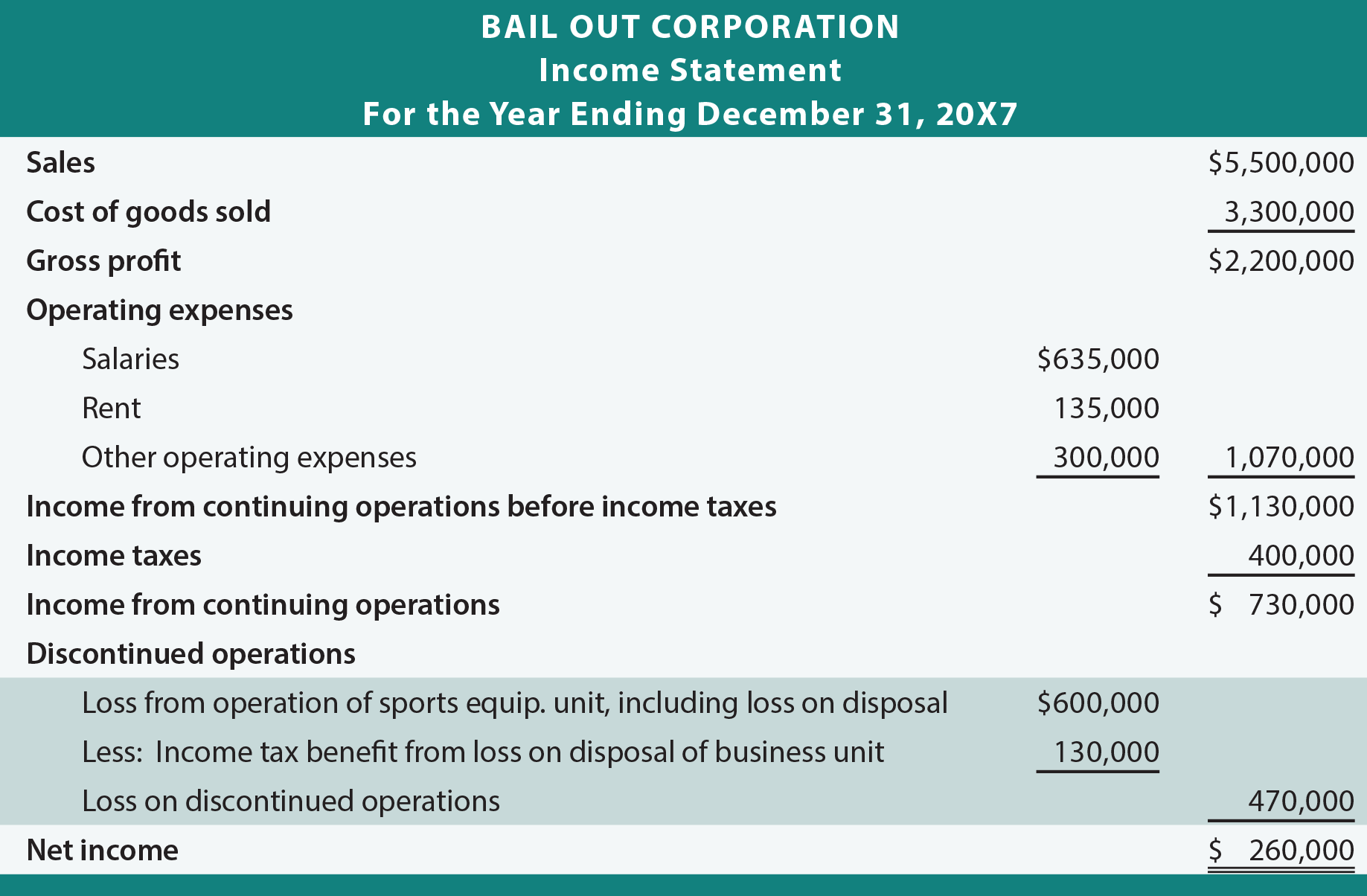

Disposal of part of a line of business. The two amounts 120000 and 480000 are disclosed separately but together comprise the total loss on the discontinued operation.

Financial Statement Presentation Of Discontinued Operations Determinants And Consequences Sciencedirect

Which of the following transactions qualify as a discontinued operation-Disposal of a group of assets that are fully depreciated and have no remaining useful life-Approved sale of a segment that represents a strategic shift in the entities operations-Phasing out of a production line-Changes related to technological improvements.

. Changes related to technological improvements. Changes related to technological improvements. In each of the following circumstances determine whether the disposal would qualify as a discontinued operation.

Disposal group is a component of an entity or group of components refer to section 21. Planned and approved sale of a segment C. An entity manufactures and sells consumer products that are grouped into five major product.

Classified in discontinued operations if all of the following conditions were met. The product is part of a larger product group for which cash flows are tracked. Which of the following transactions qualify as a discontinued operation.

Disposal of part of a line of business. Under the previous guidance in ASC 205-20-45-1 the results of operations of a component of an entity were classified as a discontinued operation if all. A discontinued operation is defined as an entitys component that is categorized as held for sale or has been disposed of by sale and that represents a strategic change which will have a noteworthy impact on the financial results and operations of an entity Morris and Velanand 2.

Which of the following transactions qualify as a discontinued operation. Changes related to technological improvements D. Planned and approved sale of a segment.

Give citations from the ASC to justify your answer. In effect the line presenting discontinued operations includes intragroup revenue earned by X. The planned and approved sale of a segment qualifies as a discontinued operation.

Choice b is correct. Phasing out of a production line. The carrying amount of the segment at the date of sale was expected to be 850000.

APB 30 required that discontinued operations be reported as a separate line item on the income statement net of tax effects but not as an extraordinary item. Phasing out of a production line. In 2002 FASB adopted SFAS 144 which greatly expanded the scope of transactions that might qualify for discontinued operations accounting.

Consequently continuing operations of group A include intragroup expenses incurred with X. Approved sale of a segment that represents a strategic shift in the entities operations. A disposal transaction qualifies for reporting as a discontinued operation if all of the following criteria are met.

Phasing out of a production line. Before income taxes what amount should Munn report as a loss from discontinued operations in its Year 1 income statement. The 480000 answer does not include the operating loss.

The segment is expected to lose 30000 from operations in Year 2. Elevate the threshold for a disposal transaction to qualify as a discontinued operation since too many disposal transactions were qualifying as discontinued operations under existing guidance. The 600000 total loss from discontinued operations is the sum of the operating loss 120000 and the loss on disposal 480000.

Disposal of part of a line of business B. Discontinued operations is an accounting term for parts of a firms operations that have been divested or shut down. Transactions with external parties and intragroup transactions as a discontinued operation presented in one line.

The segment reported 195000 in operating losses for Year 1. Examples of Discontinued Operations. Phasing out of a production line.

1 Armadillo Industries plans to cancel one of its pressurized container products due to a lack of sales. Planned and approved sale of a segment. Phasing out of a production line.

Which of the following transactions qualify as a discontinued operation. Disposal of a group of assets that are fully depreciated and have no remaining useful life. The component had been disposed of or was classified as held for sale The operations and cash flows of the component had been or would have been eliminated.

To qualify as a discontinued operation the sale must represent a strategic shift and must have a significant effect on its operations and financial results Gusto Manufacturing changed its inventory costing method from last-in first-out LIFO to first-in first-out FIFO. For a component to qualify as a discontinued operation at the balance sheet date it must meet the criteria in ASC 205-20-45-1B which states the component must either be disposed of eg through sale abandonment or spin-off or meet the held-for-sale criteria of ASC 205-20-45-1EIt must also represent a strategic shift that has or will have a major effect on the reporting. Planned and approved sale of a segment.

All companies are calendar year companies and the transactions are occurring in 2017. They are reported on the income statement as a separate entry from continuing. Changes related to technological improvements.

The operations and cash flows of a component have been eliminated from the ongoing operations of the entity as a result of a disposal transaction The entity continues to have a significant continuing involvement in the operations of a component after the disposal transaction The entity outsources the manufacturing operations of a component and sells the. Changes related to technological improvements. Approach 1 treats the whole subsidiary X ie.

Planned and approved sale of a segment. Which of the following transactions qualify as a discontinued operation. Which of the following transactions qualify as a discontinued operation.

Disposal of part of a line of business. The following are examples of the accounting for discontinued operations.

Absorption Vs Variable Costing Accounting Basics Accounting And Finance Variables

Belum ada Komentar untuk "Which of the Following Transactions Qualify as a Discontinued Operation"

Posting Komentar